Average Birmingham, AL Car Insurance Rates:

- State Minimum Liability: You can expect to pay $67 a month or $805 a year.

- Full Coverage: You can expect to pay $240 a month or $2,874 a year.

| AL City | Annual Premium | Avg. Monthly Costs | Luxury | EV / Electric | SUV | Truck | Car /Sedan |

|---|---|---|---|---|---|---|---|

| Abbeville | $2,097 | $175 | $2,715 | $1,928 | $1,700 | $2,251 | $1,889 |

| Adamsville | $2,631 | $219 | $3,365 | $2,446 | $2,139 | $2,826 | $2,378 |

| Adger | $2,478 | $207 | $3,177 | $2,294 | $2,012 | $2,667 | $2,242 |

| Akron | $2,350 | $196 | $3,104 | $2,147 | $1,878 | $2,518 | $2,105 |

| Alabaster | $2,429 | $202 | $3,077 | $2,269 | $1,984 | $2,615 | $2,200 |

| Albertville | $2,293 | $191 | $2,933 | $2,126 | $1,865 | $2,465 | $2,077 |

| Alexander City | $2,154 | $179 | $2,805 | $1,977 | $1,738 | $2,309 | $1,940 |

| Alexandria | $2,285 | $190 | $2,924 | $2,119 | $1,856 | $2,454 | $2,069 |

| Alpine | $2,314 | $193 | $3,006 | $2,131 | $1,866 | $2,485 | $2,083 |

| Andalusia | $2,088 | $174 | $2,774 | $1,897 | $1,665 | $2,239 | $1,866 |

Average Full Coverage Car Insurance Costs for Birmingham

Used Vehicle Rates:

Based on our data set for used vehicles, the car insurance costs for Birmingham are as follows:

- Annual Premium: The average annual premium for used vehicles in Birmingham is $2,490. Monthly costs are approximately $208.

- Luxury EV/Electric Vehicles: For luxury electric vehicles, the annual premium is $3,064.

- SUVs: The annual premium for used SUVs in Birmingham is $2,139.

- Trucks: Insurance for used trucks costs $2,605 annually.

- Cars/Sedans: For standard used cars or sedans, the annual premium is $2,205.

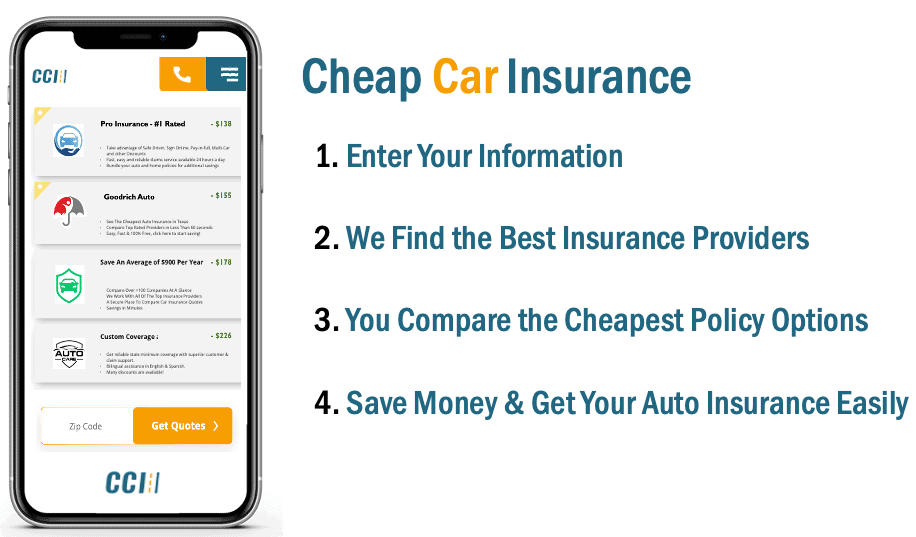

How to Find Cheap Birmingham Car Insurance

Finding cheap car insurance in Birmingham, AL using the CheapCarInsurance website involves a few straightforward steps. Here’s a detailed guide to help you through the process:

- Enter Your ZIP Code:

- On the homepage, you will find a field to enter your ZIP code. Enter a Birmingham, AL ZIP code (e.g., 35203, 35209, etc.).

- Provide Vehicle Information:

- Fill in details about your car, such as the make, model, year, and any safety features it might have. This information helps in getting accurate quotes.

- Enter Personal Details:

- You will need to provide personal information like your age, gender, marital status, and driving history. Insurance rates are influenced by these factors.

- Choose Coverage Options:

- Select the type and level of coverage you need. You can choose from basic liability to comprehensive coverage. We will guide you through the options.

- Review Quotes:

- Cheap Car Insurance will find a list of quotes from various insurance providers. Review these quotes carefully, comparing not just the price but also the coverage details.

- Compare Discounts:

- Look for any discounts you may qualify for. These can include safe driver discounts, multi-car discounts, and discounts for having certain safety features on your car.

- Read Reviews and Ratings:

- Consider reading reviews and checking the ratings of the insurance providers. CheapCarInsurance often provides this information to help you make an informed decision when available.

- Select the Best Option:

- Once you have reviewed and compared all the quotes, select the insurance provider that offers the best coverage at the most affordable rate for your needs.

By following these steps, you can efficiently use CheapCarInsurance to find affordable car insurance options in Birmingham, AL. Make sure to periodically review your insurance needs and compare quotes to ensure you are always getting the best deal.

Cheapest Car Insurance Companies in Birmingham

When searching for the most affordable car insurance in Alabama, it’s essential to compare various providers to find the best rates. The following companies offer some of the most competitive insurance premiums in the state:

1. Progressive

- State Minimum: $457 annually ($38 monthly)

- Full Coverage: $1,673 annually ($139 monthly)

Progressive stands out as one of the cheapest options for both state minimum and full coverage insurance in Alabama. With an annual premium of $457 for state minimum coverage, it provides significant savings for budget-conscious drivers. The full coverage option is also relatively affordable at $1,673 per year.

2. USAA

- State Minimum: $535 annually ($45 monthly)

- Full Coverage: $2,176 annually ($181 monthly)

USAA offers competitive rates, particularly for military members and their families. With state minimum coverage costing $535 annually, it is an excellent choice for those eligible for USAA services. Full coverage insurance is priced at $2,176 per year.

3. GEICO

- State Minimum: $654 annually ($54 monthly)

- Full Coverage: $2,475 annually ($206 monthly)

GEICO is another provider known for its affordable rates. The state minimum coverage is available for $654 per year, while full coverage is priced at $2,475 annually. GEICO’s rates are appealing, especially for drivers seeking comprehensive coverage options.

4. Allstate

- State Minimum: $721 annually ($60 monthly)

- Full Coverage: $2,450 annually ($204 monthly)

Allstate offers a variety of discounts and policy options that can help reduce insurance costs. The state minimum coverage costs $721 per year, and full coverage is available for $2,450 annually. Allstate’s extensive network and customer service reputation make it a reliable choice.

5. State Farm

- State Minimum: $935 annually ($78 monthly)

- Full Coverage: $3,110 annually ($259 monthly)

State Farm, while slightly more expensive than the other providers listed, offers robust coverage options and exceptional customer service. The state minimum coverage is $935 annually, and full coverage costs $3,110 per year. State Farm is known for its personalized service and extensive agent network.

Choosing the Right Provider

When selecting an insurance provider, it’s important to consider more than just the premiums. Factors such as customer service, claims processing, and available discounts can significantly impact your overall satisfaction with an insurance company.

Tips for Reducing Insurance Costs

To further reduce your car insurance costs, consider the following strategies:

- Take Advantage of Discounts: Many insurers offer discounts for safe driving, multiple policies, and vehicle safety features.

- Improve Your Credit Score: A higher credit score can help lower your insurance premiums.

- Adjust Your Coverage: Review your coverage options and adjust them according to your needs and budget.

By comparing rates and considering the additional factors mentioned above, you can find the most cost-effective car insurance provider in Alabama that meets your specific needs.

Car Insurance Coverage Requirements in AL

In Birmingham the amount of car insurance coverage you will need goes as follows:

- $25,000 for injury/death to one person

- $50,000 for injury/death to more than one person

- $25,000 for damage to property